When To Drop Full Coverage Insurance Coverage On An Older Car

You can file a without insurance driver claim with your own insurer if you bring without insurance motorist coverage. You can likewise file a claim against the uninsured at-fault motorist, yet numerous have no money or savings account to pay a judgment. The reality is that some mishaps are extra extreme than others, which can lead to even more severe injuries.

Lots of accidents include just 2 automobiles-- you and the at-fault vehicle driver. Yet others can consist of several lorries or a number of insurance coverage. If your injuries are severe, an experienced attorney can recognize policies or sources of payment.

What Occurs If The At-fault Chauffeur Doesn't Have Insurance Policy?

The minimum required protection is $25,000 per person and $50,000 per accident. This coverage is obligatory for all vehicle insurance plan in New york city. This coverage takes care of medical costs, shed salaries, and other losses when the at-fault event does not have enough insurance protection.

Contrast Vehicle Insurance Prices For 18-year-olds

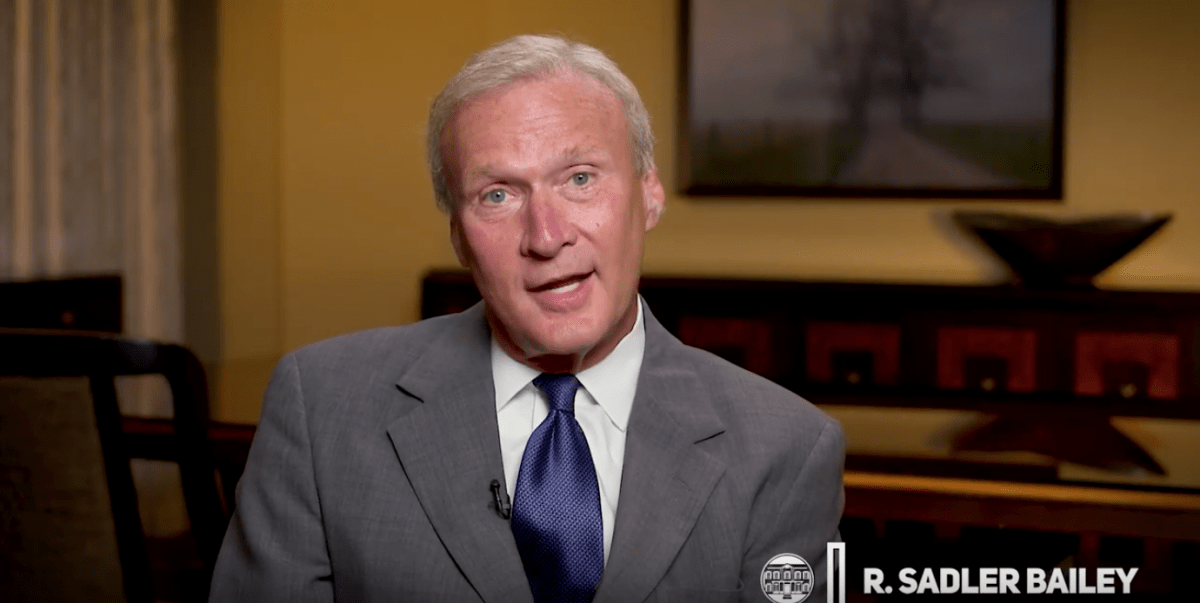

- Consulting a vehicle crash legal representative from the Legislation Offices of Robert E. Brown, P.C.It's often sensible for cars and truck mishap targets to get regional lawful assistance.Maria Filindras is an economic consultant, an accredited Life & Medical insurance agent in The golden state, and a participant of the Financial Evaluation Council at Policygenius.An underinsured driver insurance claim will normally take a little longer to develop, a minimum of until your medical treatment proceeds and you get an understanding of the worth of your auto crash case.For example, no-fault states call for all chauffeurs to have insurance policy that pays for their own injuries, no matter that is at mistake in a crash.

Legal depiction is often required to navigate these complexities, and attorneys might work with contingency, suggesting they only earn money if the instance succeeds. When involved in a vehicle accident with a driver that is not guaranteed or is underinsured, the initial thing you should establish is whether you remain Great post to read in a neglect state or a no-fault state. If you remain in a no-fault state, you ought to claim payment from your insurance firm.

If a claim surpasses your insurance coverage limitations, you are still responsible for the damage triggered in the mishap. Comparing auto insurance prices is the essential to obtaining the most effective rate for your plan. There's no leaving the greater price of auto insurance for teens, but you can still conserve cash by comparing auto insurance policy quotes if you're including a teen chauffeur to your policy. By age 30, vehicle drivers generally have fewer mishaps than more youthful chauffeurs and can improve automobile insurance coverage quotes. As soon as you've paid off your car, you can drop comprehensive and accident anytime, but that does not imply you should.

But, there are alternatives to help if you're hit by somebody without insurance policy. Without insurance vehicle driver protection and the Colorado Criminal Activity Victim Settlement Program can supply financial support. Let's say, for instance, the at-fault motorist has a $100,000 plan limit contracted with their insurer, yet your problems total $170,000. That added $70,000 would certainly fall under the "excess judgment" the court granted.

When you have these protections, the insurer spends for lorry repair work (after you fulfill your insurance deductible) if the damages results from a covered case. If the insurance provider declares your automobile a failure, the insurance company sends out the lender a check for the car's actual money worth, minus your insurance deductible. You are accountable for the remaining amount if the insurance policy payout isn't adequate to pay off your finance or lease balance. With unknown terms and many alternatives, you might be unclear what protection you require and how to get a reasonable cost. So, we asked three automobile insurance coverage experts to share their advice for navigating the procedure. Becoming a first-time vehicle driver is exciting yet overwhelming with brand-new duties. These limitations might not suffice to cover all expenditures in an extreme accident. If the at-fault driver's policy is worn down before all costs are paid, you might be stuck holding unsettled medical costs and repair service bills. If you find on your own in a vehicle accident due to the negligence of one more driver, you may rely on their insurance policy to cover the expenditures connected to problems or injuries. However, the extent of the crash might lead to considerable expenses for you. In such situations, the insurance of the at-fault motorist can aid in covering a substantial section of these expenditures. However, if the driver responsible for the crash has insufficient or no insurance, you might wonder about the readily available options.